Embarking on the journey of understanding Private Health Plans from Cigna, this guide aims to provide valuable insights and practical tips for navigating the complex world of healthcare coverage.

As we delve deeper into the intricacies of private health plans, we will uncover the key features, types of plans offered by Cigna, and how to make the most of your coverage.

Understanding Private Health Plans from Cigna

Private health plans are insurance policies that individuals or employers can purchase to cover medical expenses. These plans provide access to a network of healthcare providers and services, offering financial protection against high medical costs.

Key Features of Cigna's Private Health Plans

- Comprehensive Coverage: Cigna's private health plans typically include coverage for hospital stays, doctor visits, prescription drugs, preventive care, and more.

- Network of Providers: Cigna partners with a wide network of healthcare providers, ensuring access to quality care.

- Wellness Programs: Cigna often offers wellness programs and resources to help members maintain their health and prevent illness.

- Telehealth Services: Many Cigna plans include telehealth services, allowing members to consult with healthcare providers remotely.

Benefits of Choosing a Private Health Plan

- Customization: Private health plans often offer more flexibility in choosing coverage options that suit individual needs and preferences.

- Quality Care: Private plans typically provide access to a broader network of healthcare providers, ensuring quality care and timely access to services.

- Additional Services: Private health plans may offer additional services such as wellness programs, preventive care, and telehealth, enhancing overall healthcare experience.

- Financial Protection: Private health plans can help protect individuals from unexpected medical expenses and provide peace of mind knowing that healthcare costs are covered.

Types of Private Health Plans Offered by Cigna

Private health plans offered by Cigna cater to a variety of needs and preferences, providing flexibility and choice for individuals and families seeking coverage. Let's explore the different types of private health plans available from Cigna, comparing and contrasting their coverage and costs to help you make an informed decision.

Health Maintenance Organization (HMO) Plans

- HMO plans typically require members to choose a primary care physician (PCP) and obtain referrals to see specialists.

- These plans often have lower out-of-pocket costs but restrict coverage to a specific network of providers.

- Best suited for individuals who prefer a more structured approach to healthcare and do not mind staying within a defined network for care.

Preferred Provider Organization (PPO) Plans

- PPO plans offer more flexibility in choosing healthcare providers, allowing members to see specialists without referrals.

- While PPO plans generally have higher premiums and out-of-pocket costs, they provide coverage for out-of-network care at a reduced rate.

- Recommended for individuals who value choice and want the option to see any provider without referrals.

Exclusive Provider Organization (EPO) Plans

- EPO plans combine elements of HMO and PPO plans, offering coverage within a specific network of providers without requiring referrals.

- Members must seek care within the designated network to receive coverage, but costs are typically lower compared to PPO plans.

- Ideal for individuals who want some flexibility in provider choice but are willing to stay within a defined network for cost savings.

High Deductible Health Plans (HDHP) with Health Savings Accounts (HSAs)

- HDHPs come with high deductibles and lower premiums, paired with HSAs for tax-advantaged savings to cover medical expenses.

- Members can use funds from their HSA to pay for qualified medical expenses and save for future healthcare costs.

- Suitable for individuals who want to save on premiums and have the flexibility to manage their healthcare expenses with pre-tax dollars.

Navigating Cigna's Network of Healthcare Providers

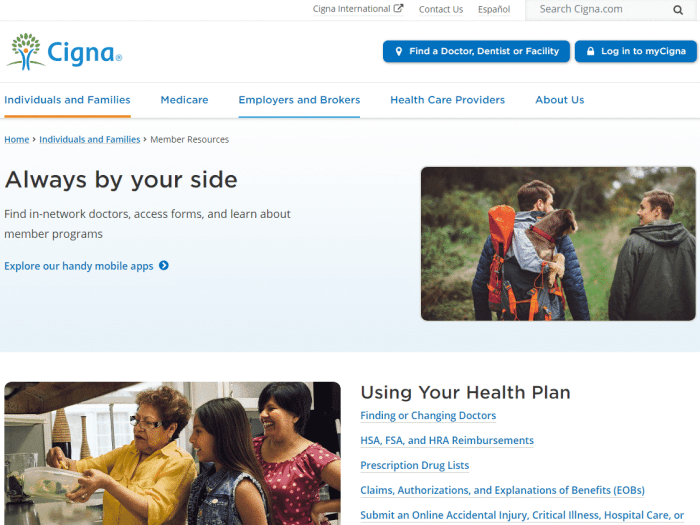

Finding in-network healthcare providers with Cigna is essential for cost-effective care and maximizing your benefits. Here's how you can ensure you're staying within the network and accessing the care you need:

Verifying In-Network Providers

- Check Cigna's online provider directory: Utilize Cigna's online tool to search for in-network healthcare providers in your area. This directory is regularly updated to ensure accuracy.

- Call Cigna customer service: If you prefer to speak with a representative, you can call Cigna's customer service line to inquire about specific providers and their network status.

Importance of Staying Within the Network

Staying within Cigna's network of healthcare providers is crucial for cost-effective care. Here's why:

- Lower out-of-pocket costs: Visiting in-network providers typically results in lower co-pays, coinsurance, and deductibles compared to out-of-network providers.

- Maximize your benefits: By choosing in-network providers, you can fully utilize your insurance benefits and avoid unexpected expenses.

Tips for Verifying Provider Coverage

- Confirm with the provider's office: Before scheduling an appointment, double-check with the provider's office to ensure they accept your specific Cigna plan.

- Review your plan documents: Take the time to review your plan documents or contact Cigna to verify which providers are considered in-network for your particular plan.

Understanding Coverage and Benefits

When it comes to private health plans offered by Cigna, understanding the coverage and benefits is crucial for making informed decisions about your healthcare needs.

Coverage Options Provided by Cigna

- Cigna's private health plans typically cover a wide range of medical services, including hospital stays, doctor visits, and specialist consultations.

- Emergency care, surgery, diagnostic tests, and maternity care are also commonly covered under Cigna's plans.

- Some plans may offer coverage for alternative therapies, such as acupuncture or chiropractic care, depending on the plan selected.

Common Benefits Included in Cigna's Plans

- Preventive care services, like annual check-ups, vaccinations, and screenings, are often covered at no extra cost to the policyholder.

- Prescription drug coverage is a standard benefit in Cigna's plans, helping to offset the cost of medications prescribed by healthcare providers.

- Mental health services, including therapy sessions and counseling, are typically covered to support the overall well-being of plan members.

Additional Coverage Options and Supplemental Benefits

- Cigna may offer additional coverage options for dental and vision care, which can be added to a health plan for comprehensive coverage.

- Supplemental benefits like wellness programs, telehealth services, and fitness memberships may also be available to enhance the overall healthcare experience for members.

- Some plans may include coverage for travel vaccinations, hearing aids, or home healthcare services for added convenience and peace of mind.

Final Conclusion

In conclusion, mastering the art of navigating Cigna's private health plans is crucial for maximizing your healthcare benefits and ensuring quality care. Armed with the knowledge gained from this guide, you are well-equipped to make informed decisions about your health coverage.

FAQs

What are private health plans?

Private health plans are insurance policies that individuals purchase directly from an insurance provider, such as Cigna, to cover medical expenses.

How can I find in-network healthcare providers with Cigna?

You can easily find in-network healthcare providers by using Cigna's online provider directory, contacting customer service, or asking the provider directly.

What are some common benefits included in Cigna's private health plans?

Common benefits in Cigna's plans may include preventive care services, coverage for prescription drugs, mental health services, and access to wellness programs.